7 Best Online Bookkeeping Services for Small Businesses

Category : Bookkeeping

In other words, debit is all incoming money, while credit is all outgoing money. Because every client and their needs vary so widely, we provide flexible, unique pricing for every client. Get in touch with one of our specialists today to get your quote or click here to get started. With access to 1M+ customer reviews and the pros’ work history, you’ll have all the info you need to make a hire. Forensic accountants investigate financial crimes involving fraud, embezzlement and other issues. They often work closely with law enforcement and lawyers, and they can help determine the legality of financial activities, according to the BLS.

Part Time Remote Bookkeeping Jobs Near Me at Imaginary Finance Co.

Most services touch base monthly, but in some cases, you can pay extra to receive weekly reports. Depending on the company, you can speak with your bookkeeper (or team of bookkeepers) as often as you’d like or at least a few times per month. Online bookkeeping services, also called virtual bookkeeping services, are a very affordable alternative to the traditional employee bookkeeper. To put this in perspective, a bookkeeping company near me bookkeeper’s average salary is $44,527. On the other hand, most online bookkeeping services start at the $200-$400 per month range, with more advanced solutions in the $600-$800 range still being significantly cheaper than hiring a bookkeeping employee. Online bookkeeping services typically range from around $200 per month to well over $500 per month if you opt for more frequent reports or back-office add-ons.

- If the hours you spend working with your accounting software could be better spent elsewhere and you’re already using the software as efficiently as possible, it might be time to hire an online bookkeeping service.

- Our high service quality and «raving fan» clients are the result of our commitment to excellence.

- We do not accept anything less from ourselves and this is what we deliver to you.

- Bench also includes visual reports, a mobile app, automated statement imports, customer support, a dedicated login for your CPA, and tax-ready financial statements.

- Collaborate with your peers, support your clients and boost your practice.

- Other add-ons include inventory management, payroll and 1099 support.

Riu Plaza New York Times Square

- When you have a Small Business Plus plan or higher, you get unlimited online support.

- Typically, bookkeepers cannot file tax returns on behalf of other companies on their own.

- When bookkeeping tasks become too time-consuming to handle on your own, hiring an online bookkeeping service can be a worthwhile investment.

- We will answer all of your questions, as they impact both your tax and financial situations.

- All firms listed in the directory have staff members trained in Xero and eight or more clients on Xero.

If you only need periodic help, pay as you go for $49 per month plus $125 per hour for support. Otherwise, monthly pricing starts at $399 and weekly pricing starts at $549 per month. If you haven’t always been diligent about your financial record-keeping, most bookkeeping services will go through your old receipts, invoices and bank statements to bring your books up to date. This service usually carries an additional fee, so it’s important to price out your catch-up bookkeeping costs while searching for a bookkeeping service.

Accounting and Tax Services

Some bookkeeping services charge a monthly fee while others charge by the hour. You can find services for as little as $20 per month while others run thousands per month. Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus.

- Proprietary bookkeeping software could make it difficult to switch to another provider in the future.

- Our platform allows you to automate data inputs from most major providers to avoid common mistakes.

- As a business owner who’s in charge of so much, managing your finances can become complicated and tedious, even with the best accounting software.

- If you have questions feel free to contact one of our representatives and visit the about us page.

- We go beyond preparation to strategize with you throughout the year, identifying ways to minimize liabilities and enhance financial opportunities.

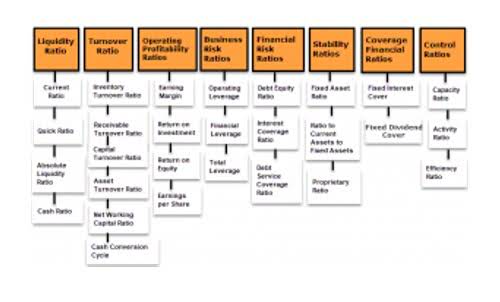

- At the very least, you can expect most bookkeeping services to input transactions, reconcile accounts and send you financial statements regularly.

How Bench works with your New York City business

You can also ask an accountant to provide proof of their license and credentials. Answers to commonly asked questions https://www.bookstime.com/articles/how-to-calculate-salvage-value from the experts on Thumbtack. Offers add-ons for catch-up bookkeeping and specialized bookkeeping.

Keep your business’s financial health at its peak with our comprehensive bookkeeping services. We take care of the numbers so you can focus on what you do best—growing your business and laying the foundation for lasting success. If you want your business to save time and money, then you should consider hiring a bookkeeping service. A bookkeeping service can help you stay organized and on top of your finances. According to the American Institute of CPAs, certified public accountant (CPAs) financially advise individuals, big companies and small businesses to help them reach their financial goals. For example, they can consult you on taxes and other accounting needs.

- Bookkeeper360 is best for businesses that occasionally need bookkeeping services as well as those that want integrations with third-party tools.

- Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries.

- The Forbes Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence.

- Its features include automation of tasks, Gusto payroll processing, balance sheet production, income statements, accuracy checks and transaction databases.

- Accountants’ rates vary based on their education, licenses, experience, and the work for which they are being hired.

- The IRS has a searchable database where you can verify the background and credentials of your income tax preparation professional.

- Each month, your bookkeeper organizes your business transactions and prepares financial statements.

Margaritaville Resort Times Square

You’re our first priority.Every time.